Garnishment Setup Best Practices

Best practices for setting up garnishments, child support and tax levy payments.

OVERVIEW

When you are setting up child support, tax levy, and other garnishment deduction-types in Namely, follow these best practices to ensure your payroll runs properly.

Refer to this video: Garnishment Setup Best Practices

TIP:

For instructions on how to set up garnishments, like child support or tax levies, at the company and employee levels, refer to Garnishments, Child Support, and Other Payroll Deductions.

CHILD SUPPORT DEDUCTION SETUP

Child support deductions should be set up using the Child Support – Post-Tax deduction type, except in the following instances:

-

Rhode Island agency

-

Payments that go directly to the custodial parent’s address

-

Child support annual fees

For these deductions, use the Continuing Garnishment – Post-Tax deduction type.

CHILD SUPPORT STATE REQUIREMENTS

Six states require a county name to be reported with child support deductions:

-

California

-

Florida

-

Illinois

-

Michigan

-

New York

-

Ohio

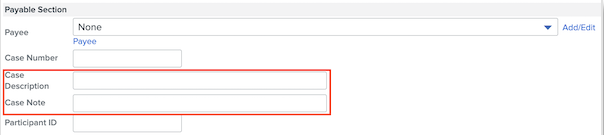

Enter the county name in either the Case Description or Case Note sections when setting up the deduction at the Employee level.

GARNISHMENT AND TAX LEVY DEDUCTION TYPE SETUP

All garnishments should be set up using the Continuing Garnishment – Post-Tax deduction type, except:

-

Minnesota Tax Levy, which should be set up with the Continuing Tax Levy – Post-Tax deduction type

WITHHOLDING ORDERS

For all deductions, you must add the withholding order to the Document tab at the Employee level after you’ve created the deduction.

You may be interested in our enhanced service, Managed Payroll, which is designed to remove the burden associated with day-to-day payroll administration. Namely will handle payroll uploads, garnishment priority processing, dedicated payroll consultant, and more!

Learn more at New at Namely - March 16, 2020 or email clientssales@namely.com to discuss service details and pricing.